Financing and purchasing a home is a very big deal to most home owners and something that one does not do very often. Therefore, it should be taken very seriously and not taken lightly. Trusting only the proven professionals who treat people like people and not just another loan number. Buying a home is a large investment and must be treated as an appreciating asset. Here's a situation we've seen and heard all too often.

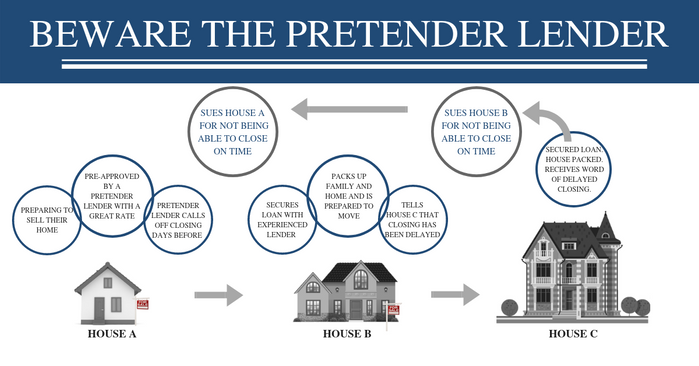

The family in house A are preparing to sell their existing home in order to finance the purchase of house B. The family in house B are also wanting to sell their existing home so that their family may also move up into a larger home by financing the purchase of house C.

This creates a chain reaction or a domino effect. Because home A chose to work with a pretender lender (online, out of town lender or call center lender) who offered the promise of a cheaper cost or a lower rate. So the danger of what happens next here when the family of home A are under contract to purchase home B, and their “pretender lender” fails to close on time, the closings for all three of these homes then become compromised since they all three needed to sell before they may qualify to finance their new purchases.

Imagine for a moment that your entire life is all packed up and your family is emotionally and physically ready to move, when the bad news arrives just a few days prior to closing….!!! The lender says oops, something is not right… And sorry we cannot close on schedule! The 1-800-mortgage-nightmare dot com low rate offer, suddenly encounters a problem….. Now imagine that the moving trucks were all loaded up, new appliances are ready for delivery, utilities are all scheduled for new service, kid’s schools have been notified and the parents now have to explain to their family, as well as their Realtors and attorney’s as to why they are not closing and moving on schedule.

When the closing date gets blown, simply because someone chose to proceed with an inexperienced lender on the promise of a lower rate or a cheaper cost… Home C is in a very strong position to sue home B and of course home B will surely sue home A who started the chain reaction in the first place. Wow!!! How disappointing this must be to have to explain this terrible situation to all parties involved, that the lender came up short, and because one chose a cheaper route, not to mention the emotional exhaustion, the added cost of legal fees, additional moving charges, additional days of interest (if you are able to still close at all) and the utter embarrassment to the family.

All of this could have been easily avoided by calling Dan for your home Finance plan… This is precisely why many top Realtors, builders and past clients all strongly recommend Dan Main Mortgage as their # 1 choice for reliable and affordable home financing solutions!

If you’re in the process of shopping around for a home loan, it’s a great idea to speak with a local, experienced mortgage professional. Dan Main at has been providing quality home loans to the community of St. Peters, Missouri for over 20 years. Whether you’re a first time home buyer, or you’re looking to refinance, Dan is known for his excellent customer service and extensive knowledge on the mortgage industry. Call him today at (636) 284-4144, stop by the office at 201 Salk Lick Rd, St. Peters, MO 63376, or visit his website for more information.

Dan Main: NMLS # 502036

Flat Branch Home Loans NMLS # 224149

947 Waterbury Falls Dr

O’Fallon, MO 63368

This is for informational purposes only and not an offer to lend or extend credit.

About the Business

Have a question? Ask the experts!

Send your question